Equifax We Are Currently Unable to Service Your Request. Please Try Again Later

In an unusual move, the FTC announced Thursday it had launched a probe into the Equifax information breach, turning up the estrus on the credit bureau later it revealed that information on 143 one thousand thousand Americans had been stolen after hackers exploited a months-quondam computer server bug.

"The FTC typically does not annotate on ongoing investigations," Peter Kaplan, acting director of public affairs for the agency, said in a statement. "However, in low-cal of the intense public involvement and the potential affect of this affair, I can confirm that FTC staff is investigating the Equifax data breach."

The move by the top consumer watchdog only underscores the severity of the information heist and the importance for consumers to take firsthand steps to secure their identities. Experts say the strongest, though not most painless, way to protect yourself later the breach that is to freeze your credit — merely the surge in demand has overloaded the credit bureaus' abilities to handle the influx of requests.

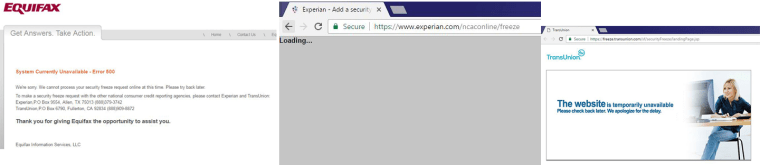

Equally of Thursday morn, all iii major credit reporting agencies intermittently gave mistake messages and prevented consumers from filing online requests to have their credit reports frozen.

Equifax's website said "Arrangement Currently Unavailable - Mistake 500" and suggested consumers endeavor contacting the other credit bureaus.

At one point, TransUnion's website couldn't be accessed at all. Then it put up an fault page featuring a stock photograph of a model sitting at a computer, aslope the caption, "The website is temporarily unavailable.Please cheque back later."

Experian's website simply said, "Loading..."

Security expert Bob Sullivan said it'south okay to await a few days until the systems better. Merely make sure yous don't go lured by confusing website copy on the credit bureau websites into signing upwards for unnecessary and costly monitoring services.

Consumers have rushed to put these "freezes" on their credit study following the massive Equifax alienation that exposed the data on over 143 meg Americans, about half the total U.S. population. These freezes — far more secure than credit monitoring alone — can preclude hackers from stealing your identity to open up a credit card or new account in your name. Once a consumer's credit written report is frozen, the only person who can "thaw" information technology is the business relationship holder, using a specially designated Pin code.

Here's how to put a freeze on your written report. Note that yous'll need your credit report "thawed" if y'all're shopping for a big purchase, like a new car or refinancing your house. The automatic process takes a few minutes by phone. And it tin can cost you lot $x to put the freeze back on. Just expert say freezing your report is your best shot at protection.

ID Theft Victim Can't Freeze Her Credit Report

Emily Lynch, a 38-year-former nurse from San Jose, California, had her identity stolen ten years ago. Having spent years since so polishing her score to a sterling "loftier 800'due south," she's eager to avoid a repeat.

"It was a total nightmare," she told NBC News. "It was a full-on investigation with the postal service inspector and all three credit bureaus. Information technology took days and months dealing with that."

But when she filed a credit freeze with Equifax after the contempo alienation was announced, the website said it was unable to process her request. When she chosen the automated credit freeze phone line, she was told that she had already had a credit freeze placed on her report. She never got a Pivot code though, and at present has no manner of unlocking information technology.

RELATED: How to Freeze Your Credit Written report

She says when she called customer service they recommended she try "tomorrow" because it was a "figurer glitch." When she asked how she would get a PIN, she says the customer service representative told her, "I don't know."

Lynch was stunned.

"This is one of the 1 of the tiptop 3 credit agencies, you're hiring people to piece of work the telephone for a huge mistake, probably ane of the largest ever for this industry, and you're hiring people who have no idea what the answers are?" she said.

Many Frustrated Consumers

Lynch is just one of many consumers feeling frustration with Equifax'due south response to the massive hack.

"Just tried to place a credit freeze on the Equifax phone line," wrote Michael Munn, a 59-year-old modest business organisation owner from Colleyville, Texas in an email to NBC News. "Afterwards entering all the info in the prompts, it comes dorsum and tells you "We're unable to process your request. Please mail in your request.'"

His and other consumers' access problems accept also expanded to annualcreditreport.com, a manner under federal police to request a free re-create of your credit written report once a twelvemonth from each of the three credit bureaus. Several readers said they received error letters at that place, too, when they tried to get a re-create of their report.

Still other consumers complained of phone lines that rang and rang with no i picking upward.

While some wondered whether the credit bureaus were intentionally throwing up roadblocks in society to avoid losing money past being able to run credit reports and other analytics for corporate clients at volition.

"I tin can't imagine them doing something like that unless in that location's a legitimate systemic reason, like they don't want their sites to crash," wrote John Uhlzeimer, a consumer credit expert who worked at Equifax in the 1990s, in an email to NBC News. "We have state and federal rights to do these things so they can't just shut down their systems to foreclose us from placing alerts and setting freezes."

Consumers also have questions nigh whether mailing in their name, appointment of birth, accost, and social security number is a secure fashion to request a credit freeze.

But privacy experts say there's cipher unsafe about using the post. The question is what happens with your data once Equifax or the other bureaus have information technology.

"The large question is whether there are appropriate post handling procedures at Equifax," New York Academy police professor Florencia Marotta-Wurgler told NBC News in an e-mail.

"Who has access to these requests with sensitive information, is the location secure, is there a system by which the data is entered into a secure system, are all of these measures complying with state of the art security in the aforementioned way other sensitive information (similar medical records, revenue enhancement data, financial data) is?"

Credit Bureaus Promise Change

Equifax and Experian did not respond emailed questions from NBC News.

In an op-ed published in Us TODAY Tuesday, Equifax CEO Richard F. Smith described the breach as "the almost humbling moment in our 118-year history."

"Consumers and media have raised legitimate concerns near the services we offered and the operations of our call centre and website. We take the criticism and are working to address a range of issues," he wrote. "We will brand changes."

The company likewise offered consumers a twelvemonth of free credit monitoring, an offer later expanded to include waiving credit report freeze fees for the side by side 30 days.

In an emailed statement to NBC News, TransUnion spokesman David Blumberg wrote, "The unprecedented number of consumers contacting us after the Equifax announcement has impacted our ability to respond to consumers equally we would like."

"We accept taken several steps to increase chapters and communication to support concerned consumers, such every bit calculation agents, keeping our call center open through the weekend and authorizing overtime," he wrote.

Simply statements like that aren't probable to mollify some angry customers.

For long-time consumer advocates, it comes as no surprise that the reliability and robustness of the consumer-facing side of these information behemoths should lag so far backside marketplace standards.

"You're not the customer, you're the commodity," said Chi Chi Wu, an attorney with the National Consumer Law Heart.

Source: https://www.nbcnews.com/business/consumer/equifax-melts-down-under-surge-angry-consumers-n800991

Post a Comment for "Equifax We Are Currently Unable to Service Your Request. Please Try Again Later"